Ask almost anyone about online sex work and the first name they’ll utter is OnlyFans.

There’s good reason for that.

In the last half decade OF has become the default “mental image” of digital sex work. It turned a subscription model into a global marketplace, one of the world’s most profitable companies.

Likewise, it turned thousands of everyday creators into brands; while making headlines in Vice and Cosmo with the seductive possibilities of six-figure months and “quit your day job” narratives – all of which echoes across social feeds and fuels the machine with more aspiring creators.

Still, as dominant as OnlyFans is, it is not the entirety of the digital sex economy. At AdultVisor we have a broader view. OnlyFans is one major venue among many that online sex workers rely on.

And in 2026, the online sex work landscape is defined by opportunity types as much as by individual platforms.

The Core Categories of Online Sex Work

Online sex work breaks down into a handful of repeatable models.

- Live versus recorded.

- Public versus private.

- Immediate payment versus delayed payoff.

Each category below attracts a different type of worker and a different type of customer, with its own risks, ceilings, and trade-offs.

Subscription and Fan Platforms

This is the category most people mean when they say OnlyFans.

And it’s really no surprise to see it enter the public zeitgeist, since OF genuinely does have the fire-power to net insane revenue for a successful model, even if the average model nets just $150-$180 per month.

Most of the public needs no introduction to the highly effective OF model:

Creators publish gated content behind a monthly paywall. Revenue comes from subscriptions, tips, and paid messages. The work is front loaded, so content has to be produced consistently to retain subscribers. Growth depends on external traffic, personal branding, constant audience management, and in many cases… notoriety.

A well-placed scandal/rumour/newspaper mention can drive thousands in revenues for an OnlyFans model.

But… OnlyFans is not the only subscription platform in town.

In many ways, it has invited competition on itself.

Back in 2021 the company announced an impending ban on sexually explicit content. The decision was framed as a compliance issue tied to payment processors, but it went down like a lead balloon. A reversal came days later after backlash from creators and public pressure.

The damage was already done, though…

This is where rivals like Fansly and Fanvue gained real traction. They offered similar tooling with clearer adult content commitments and fewer public wobble moments. None have displaced OnlyFans at the top, but we see a much wider pool of platforms available to models these days.

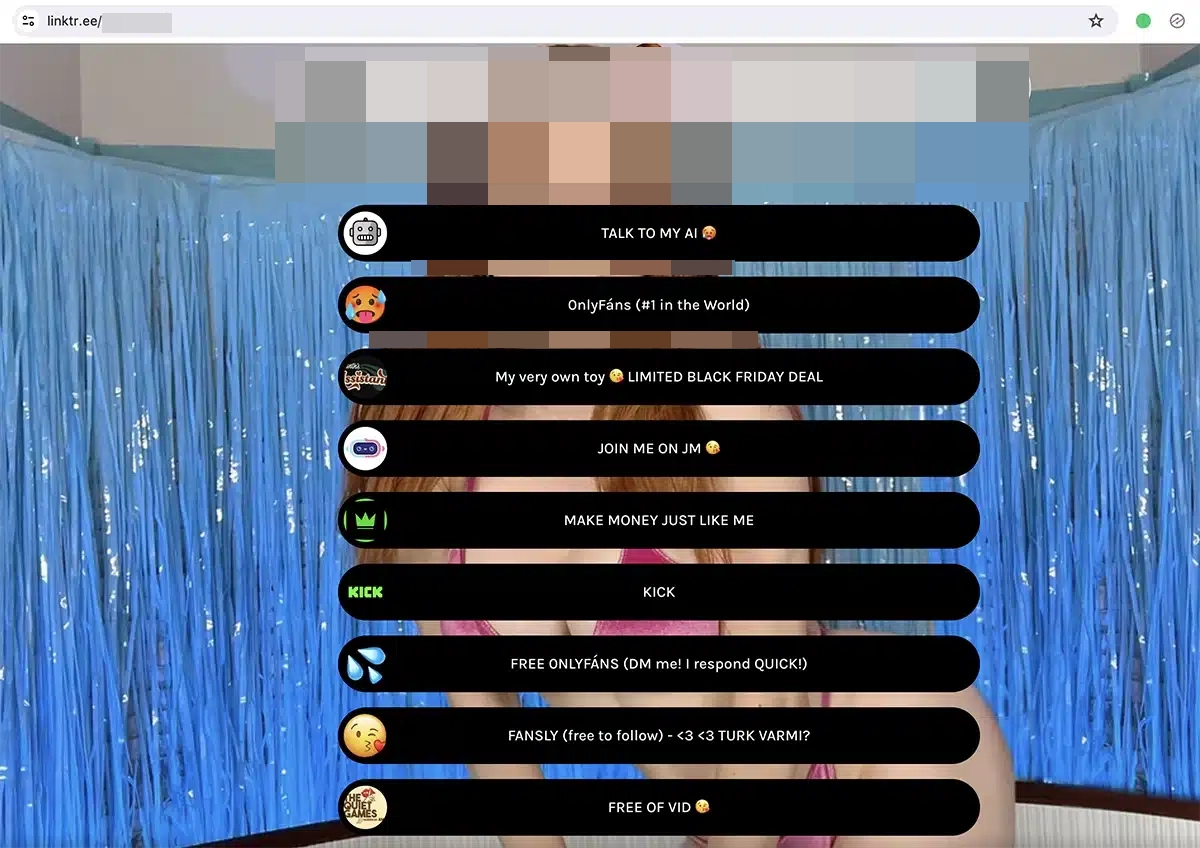

In fact, check a top adult influencer’s “linktree” and it’s common to see her content spread across multiple subscription platforms.

Much of this is to negate platform dependency.

Live Cam and Interactive Streaming

For a certain type of performer, live cam work has never lost its appeal, even as subscription platforms have swallowed most of the oxygen in the conversation, and certainly the hype in the media.

Live cam work occupies a distinct niche in the online sex economy because it converts attention directly into money… often in real time, with the satisfying sound of tips received.

Ca-ching.

Rather than building a content library and waiting for subscription renewals, cam models earn when they appear live, interact with viewers, and sell private shows. There’s no end of viable platforms, while massive forums (Amber Cutie) and subreddits (r/CamGirlProblems) exist for honing the craft.

The scale of this part of the market is significant.

Major cam sites like Chaturbate and StripChat consistently rank among the most-visited adult sites in the world, drawing hundreds of millions of visits per month; as of late 2025 Chaturbate alone was receiving nearly half a billion visits monthly, with average session durations exceeding 12 minutes… that’s user stickiness, in every sense.

Industry research also points to live streaming as one of the fastest growing forms of sexual entertainment.

We know for a fact that the pandemic accelerated this trend.

Lockdowns globally displaced many social activities online, and trafficked audiences converged on live formats for immediacy and connection. Remember the Zoom craze?!

Well, the same applied to the oldest profession in the world: sex.

Camming platforms saw surges in both content supply and viewer demand as a result. Many women (and men), hard pressed to pay the bills… turned to live cam work as a viable “side hustle”… and after realising the earning potential, many never looked back.

One experienced cam performer, who writes for AdultVisor, explained the shift toward global competition this way:

“Camming was always my bread and butter. I never chased OnlyFans because the work and the money made sense to me. After Covid, though, the rooms changed. The competition exploded in months, weeks even. It stopped being local; suddenly I was streaming alongside performers from Eastern Europe, Latin America, Asia. Everyone realised the same thing at once… the only thing that saved us from riches-to-rags was the fact that demand was growing just as dramatically, too.”

Sure enough, the earnings can be spectacular in the cams space – with foreign models making enough money to be in the top 1% percentile of earners in their countries.

It’s not all sunshine and roses though.

Cam work is notoriously tough. Live performance demands long hours, emotional stamina, and constant availability. Burnout rates are high. Competition is relentless. When traffic drops, income drops with it. The same immediacy that makes camming attractive also makes it a royal PITA.

And that intensity is why many performers eventually look for ways to decouple income from being “live”.

Which brings us neatly to clip stores and digital content marketplaces…

Clip & Content Stores

This category swaps out the immediacy of OF likes, or a front-page cam show… for durability and residual earnings.

The idea is that content is produced once and sold repeatedly.

There is no requirement to be live – or responding to DMs. No obligation to perform on demand. The catch is that revenue arrives asynchronously, sometimes weeks or months after a clip is uploaded…. and, of course, with no guarantees that it will come at all.

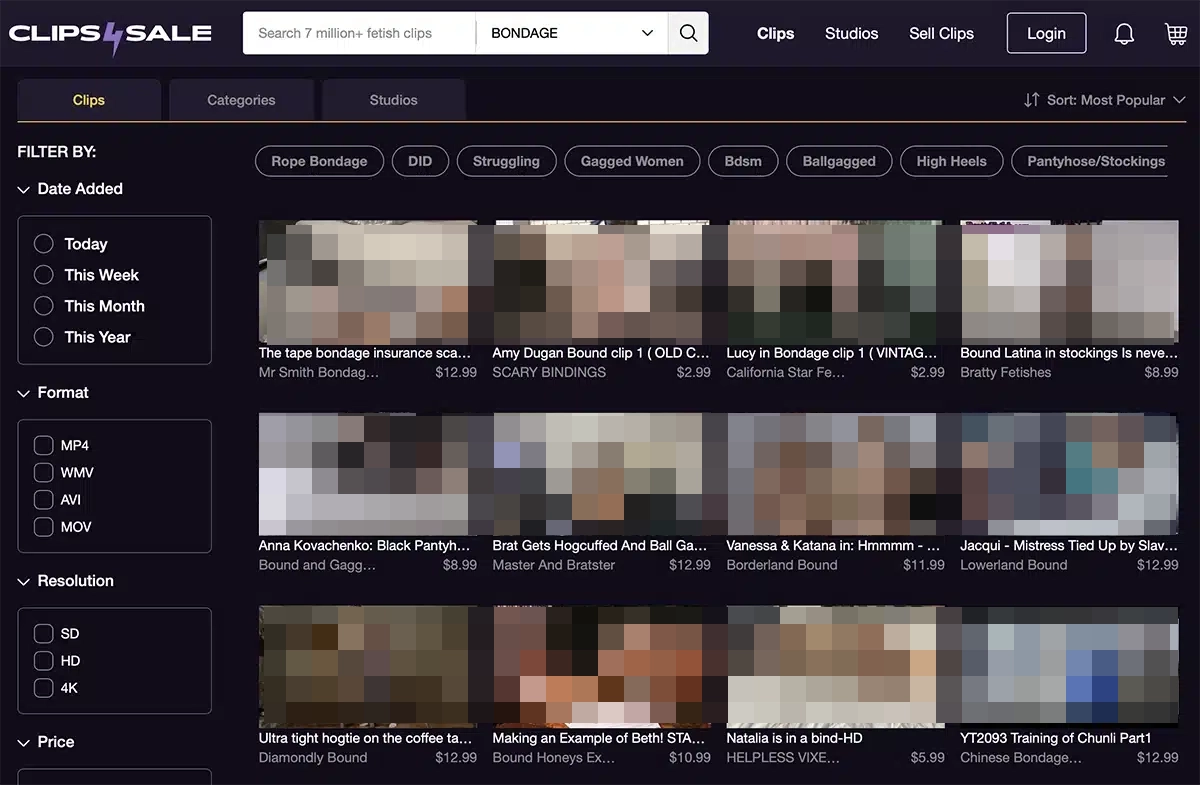

Marketplaces like ManyVids, Clips4Sale, and iWantClips operate at significant scale, especially in more fetish driven corners of the market.

Clips4Sale has built an entire business around long tail fetish demand, where specific interests generate steady sales without requiring mainstream appeal.

It started as a dedicated marketplace for foot fetish pics… but now sees everything from giantess content, to findom, femdom and cuckolding.

While many aspiring sex workers focus on the glitz and glamour of subscription platforms, old-timers know that well positioned tape libraries targeting a specific kink can still produce big money.

The hustle here is mostly volume and positioning.

Find something that works – then sell the shit out of it.

The same logic now bleeds into other parts of the ecosystem, and it’s not surprising that other adult platforms have strapped on the ‘clip store’ as a secondary means of generating income.

Subscription platforms increasingly function as hybrid clip stores. Many creators use their feeds as storefronts, pinning paid photo sets and videos that behave less like fan updates and more like permanent products. Older content gets resurfaced for new subscribers. What looks like a social feed often operates as a rolling catalogue.

Live cam platforms have followed the same path. Many now allow performers to sell prerecorded clips, photo bundles, and custom sets alongside live shows.

Of course, there is a significant downside to having such a public ‘portfolio’ of intimate work.

Sexting, Paid Chat, and Messaging Services

For many online sex workers, there’s one big factor that discourages both OnlyFans and camming: public visibility.

For those who want to earn a living discreetly, ‘paid chat’ is a much more common entry point.

This segment of the digital sex economy is built around text, voice notes, short media replies, and the sustained illusion of intimacy. Users pay per message, per minute, or per interaction.

The performer’s face may never appear. A username, typing speed and ability to pivot on a user’s wacky requests often matter more than lighting or aesthetics.

And, of course, discretion drives demand on both sides of the market.

Many users prefer chat because it fits into everyday routines. It is easier to consume privately. It does not require headphones or full attention.

Messaging also supports fantasy projection more efficiently than video, with the best earners in this space highly skilled at scene-setting and sexual storytelling through words.

Phone sex lines are the classic analog example (again, prospering greatly during the pandemic), but even digitally, platforms like NiteFlirt have operated in this space for years.

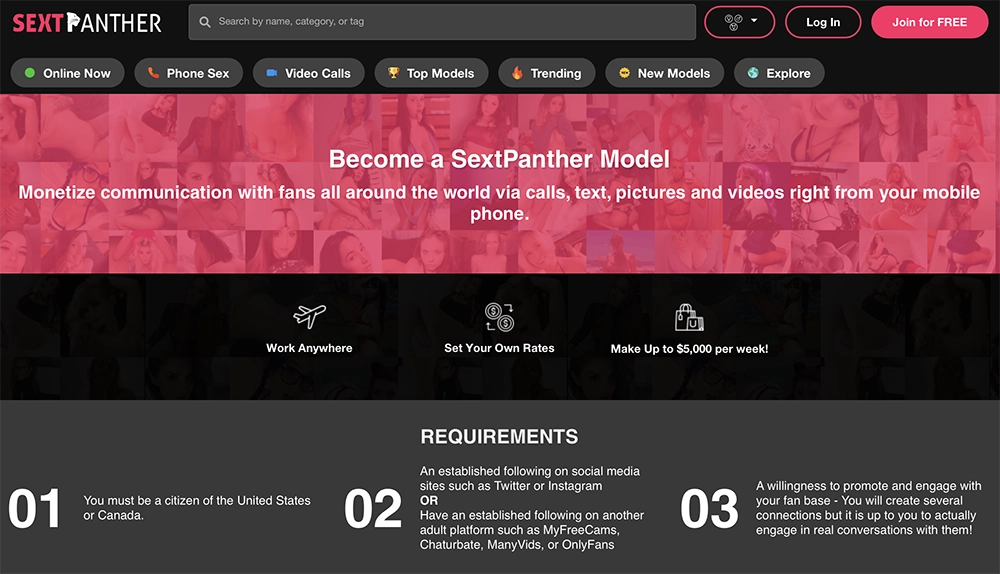

NiteFlirt predates modern subscription platforms and still hosts tens of thousands of active listings, spanning phone sex, text chat, and fetish specific services. More recent entrants like SextPanther have formalised the business model for a social media era, slapping on the gloss of paid messaging with voice notes, short clips, and tightly controlled onboarding.

From a worker’s perspective, there is no recurring revenue floor with paid sexting.

Income arrives in bursts.

A single engaged client can generate significant spend in a short window… but finding them is the ultimate source of frustration. Across multiple platforms, we see this all the time: a small number of repeat users account for the majority of earnings.

It mirrors patterns seen elsewhere in the adult industry, where – unless you are at the very pinnacle of your profession – revenue concentrates around high value customers.

The broad audience is just an ocean from which a ‘pay whale’ can hopefully be plucked.

Hard Truths About The Online Sex Work Economy

From the outside, the digital sex economy looks larger and more accessible than ever.

In raw numbers, that is certainly true.

Platforms have grown, payment infrastructure has improved, and barriers to entry are lower than they were a decade ago.

But competition has intensified in ways that are easy to underestimate.

The global adult entertainment market sits at tens of billions of dollars annually, with forecasts projecting growth from around $58 billion in 2023 toward $75–112 billion by the early 2030s. OnlyFans remains the most profitable platform in the space, reporting billions in revenue and payouts to creators each year.

But that macro growth does not translate evenly to individuals. Online sex work is now fully globalised. Creators compete alongside performers from Eastern Europe, Latin America, Southeast Asia, and anywhere with a stable internet connection. Wage arbitrage is real. So is audience fragmentation.

A small percentage of performers capture a large share of the money.

Most earn irregular or modest income. Many try briefly and disappear without a trace. This is not a failure of the system – it is how platform economies behave.

If you are reading this now, as an aspiring adult influencer, seeking a slice of a very large pie… any ambition you have must be paired against the backdrop of an insanely competitive and global marketplace.

AI, Automation, and the Next Disruption Cycle

If the online sex work economy has always been shaped by platforms and attention, the next big force reshaping it is artificial intelligence – and it is arriving faster and with more ramifications than most people realise.

We have been following the rise of AI in the adult industry closely here at AdultVisor.

What started as a gentle ripple has been accelerating month-on-month to the point where some adult creators are worried if they’ll even have jobs by the end of the year.

Are they paranoid? Is the risk genuinely so severe?

Well, the broader creative economy is already feeling AI’s impact.

Research from the World Economic Forum and financial analysts suggests that generative AI could automate a significant portion of tasks in creative sectors – as much as 26 percent of work in art, entertainment, media, and design – with both opportunity and displacement baked into the transition.

Within adult entertainment and online sex work specifically, all the early signs point to AI becoming a major structural force… not just some fringe novelty.

We often hear the refrain from adult industry execs: “Yeah, but ChatGPT hates porn lol. We’re safe for a long time yet.“

Nuh uh.

AI-generated porn is already booming, with rapid advancements in image and video generation tools.

Yes, there are still inherent flaws… but they’re being ironed out at a rate of iteration that should send a shiver down the spine of every aspiring porn star.

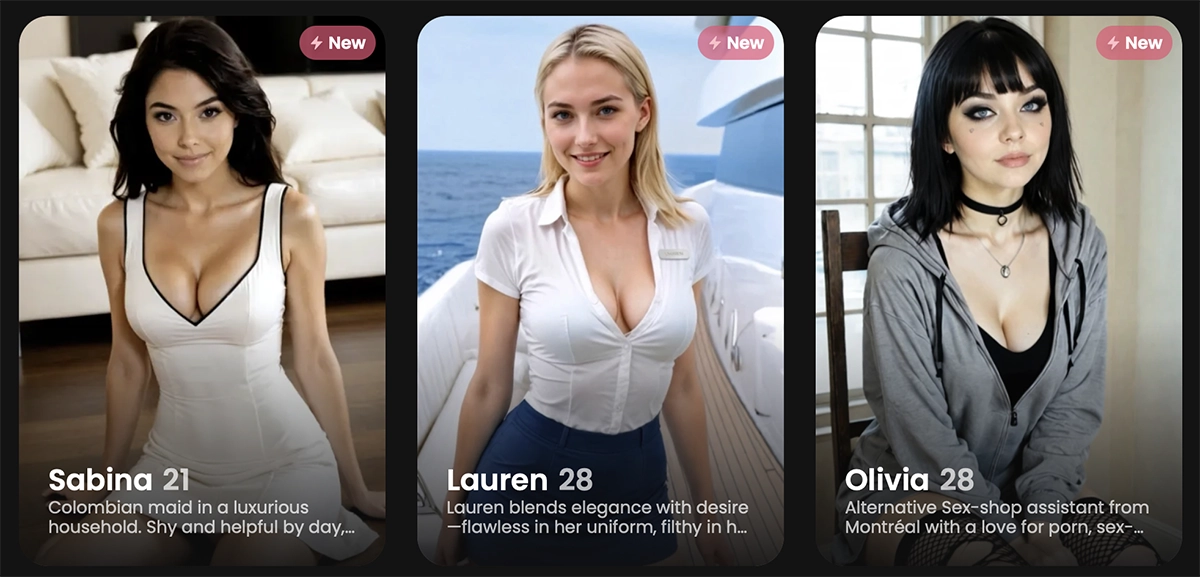

Likewise, we’ve seen a massive rise in AI-based companions (virtual AI GFs). They can chat, they can simulate intimacy & flirtation, they can send pics, videos and even “call you” with real-time voice enabled.

Much to the dismay of the professional sext artist, increasing numbers of lonely men are turning to bots for intimate companionship. And not just men, either – accordingly to The Independent (UK), over 18% of these customers are said to be female!

People of all genders are interacting with these technologies in ways that resemble social and emotional engagement, and a non-trivial portion of those interactions have a distinctly sexual or romantic dimension.

And that… is precisely why the adult industry is nervous.

We still don’t know which parts of the industry (if any) are truly “safe” from the rapid advances of AI.

What This Means For Online SWs

If you’re reading this as someone considering online sex work – or already in it – there are actionable steps you can take to future-proof your SW business.

Here’s what actually matters in 2026:

- Diversity across platforms. Platform dependency is the fastest way to see your income evaporate overnight. Spread your presence across at least two or three services. If OnlyFans wobbles again, you want somewhere else to land. We cannot stress this enough.

- Find your niche before chasing scale. The creators earning good, reliable “consistent money” aren’t competing for mainstream attention. They’re dominating specific corners of the market… particular fetishes, personas, or content styles that build loyal, repeat customers. Generic content drowns in a global talent pool… unless you are in the golden 1% of the 1% crowd.

- Build assets that outlast your availability. Live work pays immediately, but it stops when you do. Clip stores, pinned content libraries, and evergreen media create income while you sleep. The smartest workers blend both.

- Watch AI closely – and consider leveraging it. Automation is coming for the low end of the market first: generic chat, basic imagery, undifferentiated content. Human connection and authenticity become more valuable as synthetic alternatives flood the space. But AI can also be a tool – for editing, marketing, scaling your reach. The workers who thrive will be the ones who adapt rather than ignore.

- Treat this like a business, not a side hustle. Track your income. Understand your platforms’ fee structures. Know your customer acquisition costs. The performers who last are the ones who think like operators, not just creators.

The Winds of Change…

The online sex economy is larger, more competitive, and more technologically volatile than it has ever been.

While platforms have never been more profitable…

And opportunities have never been more numerous…

The margins for error have never been thinner.

AI will not eliminate human sex work overnight. But it will raise the bar for visibility, differentiation, and earning power. The era of predictability is ending.

All this means that online sex work is not a shortcut to easy money, no matter how convincing those creator threads on X might sound.

It’s a fast-moving digital economy where platforms hold most of the power, technology changes the rules mid-game, and only a fraction of participants ever make a sustainable living.

That’s not a reason to avoid it altogether.

It’s a reason to enter with clear eyes only.